Other Tax Countries Tax Changes

Tax Changes for Ghana, applicable from 1 January 2020, have been published in the Income Tax (Amendment) Act 2019 – Act 1007.

Your system was already updated in January, but we are mentioning it here for record purposes.

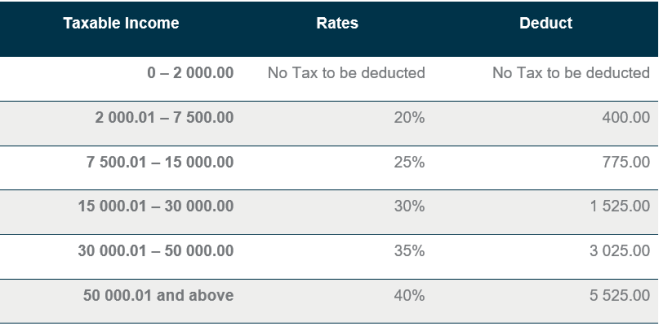

Annual Tax Table – First Schedule

Personal Reliefs – Fifth Schedule

The limits for some of the personal reliefs have increased as follows:

• marriage or responsibility relief – Increased from GHC200 to GHC1 200.

• old age relief - Increased from GHC200 to GHC1 500.

• child education relief - Increased from GHC200 to GHC600.

• aged dependent relative relief - Increased from GHC100 to GHC1 000

• training and self-improvement - Increased from GHC400 to GHC2 000

You can view the Statutory Rates of Tax by clicking on the <Tax Rates> button on any Employee’s Tax Screen or on the Basic Company Information Screen.

Amendments to Finance Law No 19/005 for 2020 was published in the National Gazette of the DRC. Paragraph 1 and 4 of Article 84 include tax rate amendments applicable from 1 January 2020.

Your system was already updated in February, but we are mentioning it here for record purposes.

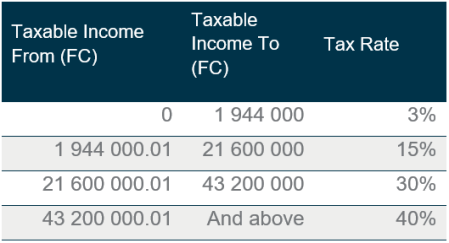

Annual Statutory Tax Rates

You can view the Statutory Rates of Tax by accessing the Africa Rule Linking Screen (Payroll > Definitions > Africa Rule Linking or use the routing code AFL).

The new tax file version is 202002.

Finance Act 2019 of Nigeria has been gazetted.

According to Section 27 of The Finance Act 2019, Section 33 of Personal Income Tax Act has been amended by deleting subsections 4, 5 and 6. The implication for payroll is that the tax relief for disability, children and dependent relatives has been deleted.

The effective date for the Finance Act 2019 is 13 January 2020. However, the Gazetted copy was only made public now in February. Because it is practical to backdate this tax change, the change will be applied from the payroll month of January 2020.

Your system was already updated in January, but we are mentioning it here for record purposes.

The Zimbabwean Revenue Authority published Pay As You Earn (PAYE) tables applicable from January 2020 (RTGS Earnings).

Your system was already updated in January, but we are mentioning it here for record purposes.

The Monthly Statutory Tax Rates which are applicable from 1 January 2020 are: